The next shift in Payments - A Tech Perspective

Subtitle: Evolution from Payments 1.0 to 4.0

The rails that power our financial system—the infrastructure beneath our everyday transactions—are transforming very quickly.

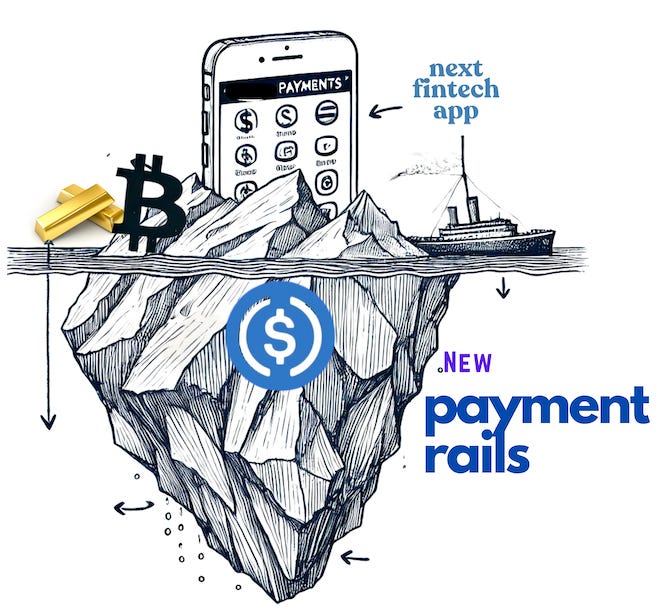

By the end of this post, hopefully you will walk away excited about how Payment systems are fundamentally evolving, what the future holds for how we transact and the technical pieces to get us there. Crypto is a big part of this future, but to see that we have to look beyond Bitcoin. Bitcoin is only the tip of the iceberg, like gold is in our traditional finance. What’s below is much more massive!

To ground this post in a customer problem, let’s follow Anika, as she navigates her day through the shifting landscape of money—from the early systems to current fintech apps and what’s coming next.

Let’s dive in. 🚀.

Payments 1.0 : The Era of Traditional Banks & Clearing Houses

Anika’s parents run a family-owned bakery and relied on paper checks from the custom cakes to wedding planners. They wait for days for checks to arrive and several more days for checks to clear. If a check bounces, it creates additional week of delays. Anika, is studying to be designer and goes abroad to study. Her parents use a traditional bank wire transfer which takes several days, incurs a high transfer fee, and results in an unfavorable currency exchange rate.

Early Financial Services were largely the domain of Traditional Banks.

Technology: To understand the technology behind this phase, let’s look at an e.g. ACH (Automated Clearing Houses). To facilitate the movement of money between people who had accounts in different banks - ACHs were created. Early on it was physical and with paper.

With advent of software over the past 30 years, these are largely implemented through batch processing. The originating bank groups all ACH requests in a specific format.

e.g. "Bank A is initiating a debit (pulling money) of $50 from an account and sending it to John Doe’s account at Bank B." into a specific batch file with rows for e.g 62712345678098765432100000050001234567890 John Doe 0123456780000001.

These are then sent at the next processing time to an ACH operator (through sftp, api ), which verifies transactions and routes to receiving banks, which batch process and settle on next business day to the Customer John Doe.

This phase of Payments 1.0 was dominated by large brick-and-mortar banks and card networks (Visa, MasterCard, American Express). Paper checks, Wire transfers, ACH were primary ways to transfer money. Settlement often took days. There were high barriers to entry and entrenched institutions held monopolies, with regulatory frameworks restricting competition.

While there was trust and oversight through federal regulations, the customer experience was slow (branch-based, paperwork-heavy), little to no innovation in user experience for decades and cross-border transfers were costly and slow.

US Payment Systems is a fantastic book to go deeper into these Payment Systems.

Payments 2.0: Fintech makes it seem “Instant”

Anika is now back in San Francisco. Signing up for new fintech apps is very easy and quick - she can do it on her phone and add to her balance in minutes instead of days it used take in 1.0 to get a bank account. When she goes out with her friends for dinner, they can“Venmo” her their share of the bill immediately. This is instant, however if Anika’s wants to move her Venmo balance to her bank account to pay the credit card bill, its 1-3 days or a fee.

During summer, Anika signs up for a neobank ahead of a trip to Europe. There are no foreign transaction fees on purchases and no need to carry large sums of local currency. This is a huge leap forward in customer experience (easy app, multi-currency wallets) but the underlying international transfers still rely on older rails with fees and delays.

Apps & Neobanks like Venmo, PayPal, Cash App, Chime pioneered this phase largely through slick UX. The biggest impact of this phase is moving us towards a cashless society and using our mobile phones for transactions.

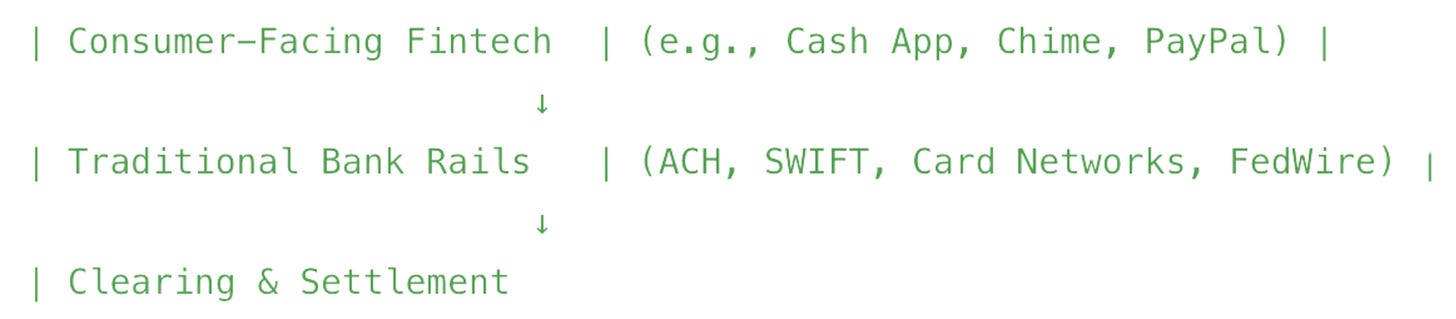

Technology in this phase is largely focused on 3 areas:

Slick Interfaces and Social/Network effects- e.g. discover people, send money, split tab. However, when you bring money into the app e.g. by connecting your debit card or bank account, its using same card network or ACH pull to get money into your Cash App balance.

Integrating with traditional payment Rails to bring money in and out of system, & management of internal balances: When you transfer money from one user to another on CashApp, thats largely managed through internal account balances, private ledgers, and reconciliation - a process for making sure the balances internally match the net in/out through all the different channels e.g. Banks, Card networks.

Investments in Risk/Fraud Detection- with ease of technology and quick signup (access) came increased risk of fraud. Previously you had to physically show up at your bank with paperwork to create an account. It was slow but more reliable. Now fraudsters can create 100s of accounts through a mobile farm using fake digital ids.

In most apps in this phase, to gain benefits of Payments 2.0, both sender and receiver have to be in the same closed system e.g. Cash App. This is because the underlying rails are not fundamentally changed in this phase and they are still slow. (There are some recent improvements e.g. with FedNow). Cross-border still remains slow and expensive.

Payments Rails 3.0: Blockchain, Stablecoins, and Programmable Money

Anika is now a content designer in Kenya working for multiple clients globally. She has setup a crypto wallet using Coinbase and receives payment from clients in USDC. She can choose to keep it in stablecoin or move it offramp to local currency seamlessly as her fintech app leverages the global integrations that Coinbase has invested in. She can also send the money directly to her family’s crypto wallet, who can then convert locally or spend at merchants accepting USDC.

Anika has started a firm that has multiple AI content generators that produce articles for a small fee. Each AI agent has a wallet that once a client agent confirms delivery, contracts release micro transactions automatically. AI can technically “own” assets on-chain (though legally a business still typically backs it).

This example seems distant but the underlying technology is almost here. In the Payments 3.0 phase, the old legacy rails are replaced with the new blockchain stack. You can now build the slick UX of Payments 2.0 and more while leveraging new rails underneath which overcome the limitations of Payments 2.0. What are these rails?

Technology: The foundation of this technology is blockchain - which is described eloquently in this paper. It uses a novel system for conducting electronic transactions without relying on trust - using coins made from digital signatures and a peer-to-peer system leveraging a public history of transactions, proof-of-work and computational complexity to prevent attackers.

Over the past years, we made foundational improvements in underlying blockchain technology which have reduced costs and increased speed of executing crypto transactions, including stablecoins by over 99%. Sending USDC on Base (Coinbase’s L2 network) - costs cents versus $25+ to send international wires!!

These investments enables anyone to have a digital wallet, move money from fiat currency to their wallet into stablecoin like USDC, and transfer that almost instantly to another global wallet either manually or programmatically through contracts.

The main components of this are:

Decentralized Infrastructure: The underlying “rail” is a distributed ledger and a novel way to make payments without trusted entities.

Stablecoins: Digital assets (e.g., USDC or central bank digital currencies) pegged to a fiat currency, aiming for minimal volatility while using blockchain’s efficiency.

Real-time, Global Settlement: Transactions settle in minutes on-chain, potentially 24/7/365, bypassing slow clearing houses.

Programmable Money: Smart contracts enable automated financial operations (e.g., escrow, micro-payments, conditional releases) without intermediaries.

Companies like Coinbase have invested significantly to build onramp & offramps from fiat currency (e.g. $) globally to digital assets (e.g. USDC) in a wallet. This is an open platform for e.g. you can transfer money from your wallet to any other wallet in the world.

This platform will power the next generation of slick fintech apps that want to build a 3.0 experience - with the above benefits. e.g. you could be using next gen CashApp to move ‘money’ to your friend, it might just be a stablecoin instead of $.

Over the past years, many of the challenges holding this phase back have started to be mitigated both through technology and government action - regulatory uncertainty, addressing volatility (stablecoins) & costs (L2..).

Most people in the US who are dealing in USD, will be skeptical of the benefit of this phase. However, it is worth keeping a couple of things in mind -

most people living outside the US will benefit from putting their money in USDC for inflation hedge and easy transfers for business.

Stablecoins are not a fad. Stablecoin activity has been steadily increasing uncorrelated to crypto trading volatility.

Stablecoins have hit product-market fit with over $xxB in USDC alone. In this world, USD is the primary reserve (over 99%) - even better than its fiat position currently. If we do not move quickly in this space, we risk another currency becoming the reserve currency in this digital asset world e.g. euro.

AI agents having a wallet that they can get paid to by another human or agent is not possible in the 2.0 world. A CashApp account requires a human entity it.

As the bitcoin paper proposes - the eventual goal is to build a new system for payments & transactions.

Payments 4.0:

Is there really a 4.0? Maybe - A World With No Fiat

Imagine there’s no “off-ramp” or “on-ramp” because we don’t need fiat currency at all. Where everything —your rent, your groceries, your entertainment subscriptions—is priced in native digital tokens like USDC or CBDC. No conversion. In this world, we don’t talk about crypto or fiat. You don’t wonder how do I convert this to dollars? - because no one around you needs dollars. We have a single, digital monetary world.

There are a lot of questions and work that needs to be done to get here. If you want to help create this future and have an outsized impact on future of Payments - please reachout.

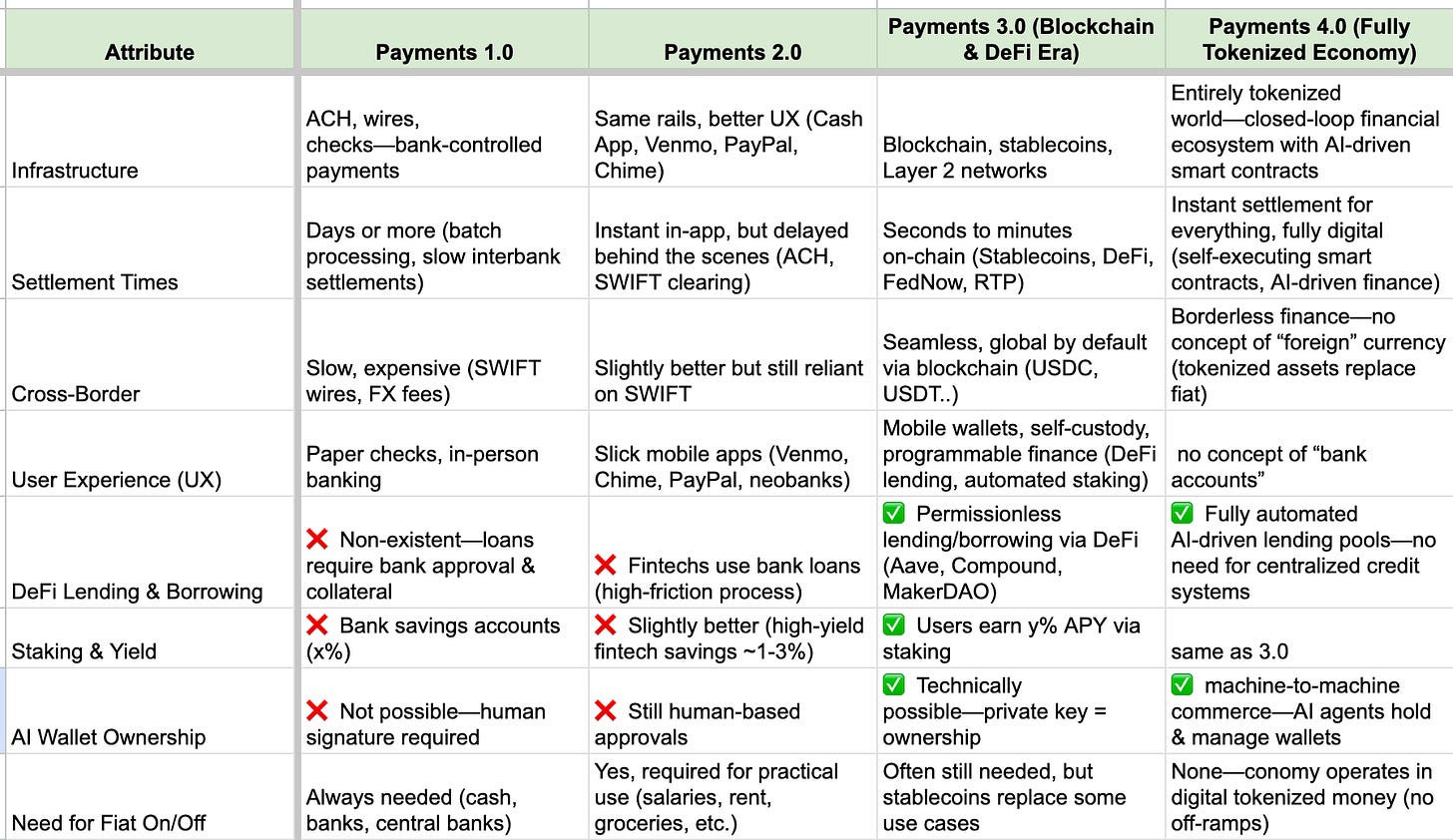

A quick comparison of the different phases:

Where Do We Go From Here?

Most of us live somewhere in 2.0 —tapping apps like Venmo or CashApp and maybe dabbled in stablecoins or crypto. Is 3.0 mainstream? Not yet. Will it be one day. Very Likely!

For now, the next time you transfer money overseas or pay a friend back for pizza, pause for a second. You’re on a ride that started with paper checks and is barreling toward a future where money might be as universal—and invisible—as Wi-Fi.